The GoBear Complete Guide to LHDN Income Tax Reliefs. Online competitor data is extrapolated from press.

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

So does this mean there are no rental income tax exemptions in 2022 YA2021.

. PAYE became a Final Withholding Tax on 1st January 2013. Is an additional tax that is used to repay all or part of the OAS pensions received by higher-income pensioners. As for the pension this is paid to you gross but still taxable.

A surtax on normal-tax net income less credit is levied at progressive rates from 25 on the first US750000 and up to 30 on surtax income over US2500000. Currently the taxpayers can choose the method of taxation of rental income ie. In tax terms the closing price is the basis Value of Land - Estimate the value of the land.

Special Income Tax Deduction for landlords in 2021 and 2022. HOWEVER the tax exemption which was gazetted as the Income Tax Exemption No. You can make things right by filing an amended tax return using Form 1040-X.

Taxpayers can also avail an addition income tax rebate of Rs. Thresholds in Canadian funds are. If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged.

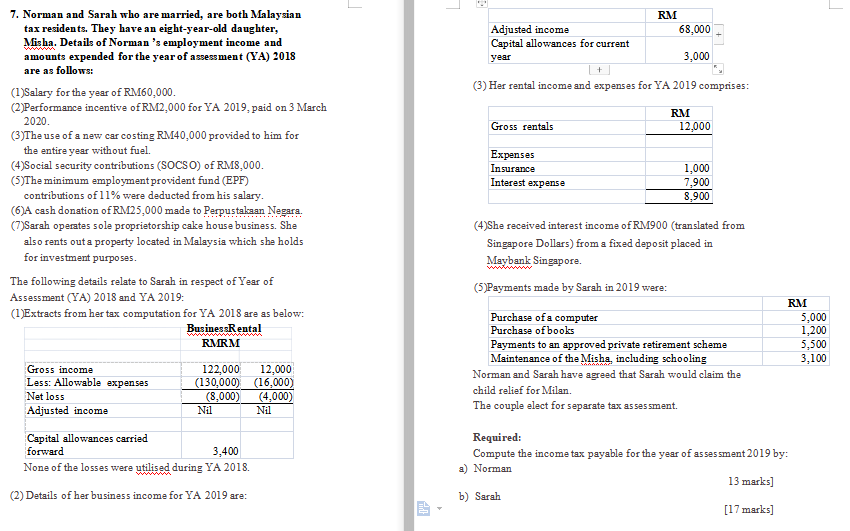

Final in the sense that once an employer deducts PAYE from the gross salarywage of a particular employee it represents the final tax liability on that income. Qualifying company undertaking intellectual property development activities in Malaysia. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer.

Tax on your rental income will still need to be paid in Ireland. The combined income tax rebate in India which can be availed under sections 80C 80CCC and 80CCD 1 is capped at Rs. Salaries of the employees of both private and public sector organizations are composed of a number of.

AirDNA reports short-term rental revenue in October 2021 was up 40 over October 2019. The existing standard rate for GST effective from 1 April 2015 is 6. Withholding tax exemption on income from.

What if youve sent in your income tax return and then discover you made a mistake. You would declare your rental income pension income and shares income on your tax return. Tax rebate for self.

Tax exemption on income determined using the Modified Nexus Approach derived from patent. Applies only if your net world income is more than the threshold for the tax year. 80 of the gross rental income needs to come from the leasing of dwelling units Code Sec.

Taxation of rental income. Rental of a ship on a voyage time charter or bare boat basis. 79845 for the 2021 tax year.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. LoanStreetmy 9 Things to know when Doing 2019 Income Tax E-Filing. As a result most employees will not be required to lodge Form S returns.

A flat tax of 20 is levied on the normal-tax net income. RinggitPlus Malaysia Personal Income Tax Guide 2020. The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable.

75910 for the 2018. The key thing to remember is that all income has a tax liability. As of 1 January 2019 individuals who derive in a tax year income exceeding PLN 1 million are required to pay solidarity tax at the rate of 4 on the excess of this.

50 000 under section 80CCD 1B subject to self-contribution or deposit to their NPS account or Atal Pension Yojana. The estimated value gets deducted from the Adjusted Basis Per IRS Publication 527 Residential Rental Property 2016 p6 Certain property cannot be depreciatedThis includes land and certain excepted. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Hi John thats correct. 77580 for the 2019 tax year.

Taxation with a tax scale or a lump sum tax on recorded revenues. Foreign expatriates and employees who will start to work in Korea no later than 31 December 2023 are able to apply for a flat income tax rate of 19 excluding local income tax on their employment income rather than the normal progressive income tax rates of between 6 and 45 excluding local income tax. 79054 for the 2020 tax year.

CompareHero 7 Tax Exemptions in Malaysia to know about. HRA or House Rent allowance also provides for tax exemptions. This is because the correct amount.

Tax rebate for. 2 Order 2019 was only for a period of one year from 1 January 2018 to 31 December 2018 and has now expired. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Programs implemented from 112019 to 31122021. World of Buzz 21 Tax Reliefs Malaysians can get their money back for this 2019. Income earned by companies is taxed on a graduated tax rate structure.

Purchase Price - The closing price or contract price of the rental property.

Malaysia Personal Income Tax Guide 2017 Ringgitplus Com

50 Tax Exemption For Rental Income 2018 2020

Media Resources Downloads Pembangunan Sumber Manusia Berhad Exemption Of Levy Order 2001 Kwsp 3rd Schedule 7 For Period Apr 2020 To December 2020 Gst Income Tax Forms Gst Forms Epf Kwsp Forms Socso Perkeso Forms News

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

Malaysia Property Market Outlook 2019

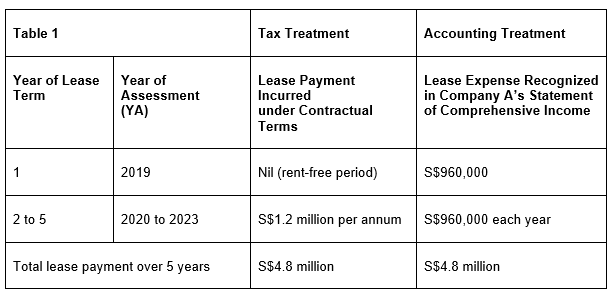

Tax Treatment For Rental Of Business Premises Crowe Singapore

How To Declare Your Rental Income For Lhdn 2021 Speedhome Guide

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

8 Things To Know When Declaring Rental Income To Lhdn

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

Get 50 Tax Deduction From Property Rental Income Fmt Beta2

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Maldives In Imf Staff Country Reports Volume 2019 Issue 196 2019

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Get 50 Tax Deduction From Property Rental Income Fmt Beta2

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

10 Things To Know For Filing Income Tax In 2019 Mypf My